Do you know your platform solution?

Do you know your platform solution?

Knowing your digital solutions is key to choose industrial platforms, as they might not meet your exact needs

What is under the hood of an Industrial Platform solution? What do you look for?

IIoT Platforms are still under significant construction

How do you judge the platforms that are out there?

Companies have this essential need to build an IoT platform today, or be at least very active partner in one, or even many, to fit their business goals. A platform connects, it connects your world with the rest of the world. Often when we talk about IIoT, it can get easily confused with IoT. Actually, IIoT, grew out of the other, IOT.

IoT is mostly about making the human interaction with the object(ives). IIoT is about connecting devices, sensors, building and improving manufacturing execution systems then applying intelligence and analytics to understand or improve the performance of the existing devices. The aim is to monitor, build parameters, sophisticated controls and search for solutions that will lessen the downtime and improve the productivity of the asset.

McKinsey estimates that the Industrial Internet of Things will create $7.5T in added-value by 2025. IIoT has been valued at around $255b as a market in 2025 (a past GE estimate). These two seem to offer very different estimates. In many ways, we are all confused and still guessing or predicting, because of so much uncertainty and not honestly knowing what comes next in technology invention that changes the position. We have learned, in our engagement and growing reliance just on the smartphone.

We have all learned to adapt and adopt so differently, as we connect more and more. In the IIoT world, there is predicted value across all of the connections (McKinsey view) and as we see more solutions emerging, as ways to serve that “connected” need market growth will more than likely simply accelerate away. Speed, scale, scope are all accelerating away, and as companies, we need to find our positioning in this evolution and industrial internet. The 4th Industrial revolution is well-under way.

Let me provide a snapshot, my view, of where IIoT platforms-as-a-service sit today.

There is a lot more behind this brief overview, if interesting for you to explore. Just scroll back through different posts I have made throughout the 2018 year on different aspects of platforms. go to the home page and scroll through in the opening part to then click on and further read if you want too. A lot on IIoT platforms is certainly happening, making it highly dynamic in their evolving story and offering.

There is presently a certain land-grab going on in the Industrial world of digital platforms.

Some of the largest organizations are offering their clients their take on a digital platform-as-a-service. I am specifically focusing on five here. GE, Siemens, ABB, Bosch and Schneider Electric ,as I have been reviewing each of these here in platform snapshots in this www.ecosystems4innovating.wordpress.com site. Do take a look, by searching for the organization’s name.

GE has been at the forefront of this in building its Predix Platform. ABB with its Ability platform, Siemens with its Mindsphere, Schneider Electrics has its EcoStruxure offering. Then you have Bosch who seem to do a consistent, thoughtful roll-out of their platform.

It is interesting that so far it seems the Japanese are lagging on this platform-as-a-service. I would have expected the Yaskawa and Yokogawa’s of this world to have these. Maybe I have not looked hard enough.

Bosch with its IoT suite is a set of solutions that I like very much.

Actually, it is a real hidden star and mastering far more of the digital challenges than the majority in its holistic approach to IIoT solutions. Bosch, so far for me, offers a real template to learn from, in their digital approaches but that’s another story, for another day, on where I can add my perspective of why they are a leading provider.

Alongside these industrial asset rich organizations, you have all the software heavyweights building their versions of platforms. Microsoft with its Azure, Amazon with its AWS, IBM and its Watson, followed by SAP, Oracle, Cisco, Ayla Networks, HPE, PTC and plenty of others, all offering the cloud and multiple services to connect data, analysis it and offer solutions back to customers. Microsoft Azure is partnering with GE, ABB, Bosch and Schneider Electric, whereas Siemens has gone far more with Amazon and its AWS platform. Then each realize it actually needs both AWS and Azure in different partnership arrangements, as clients require their main software providers to be included.

Many of the major consulting companies are also in partnerships, to build out and extend platforms-as-a-service to clients. There is such a broad spectrum of need you require in the building out of connections and services that the lone bigger industrial company platform providers cannot provide; they have multiple partnerships as their clients often require these to make the necessary integrations of their systems. The supply-side of platforms are offering a vast ecosystem of choices.

Understanding what is under the hood in an IIoT platform

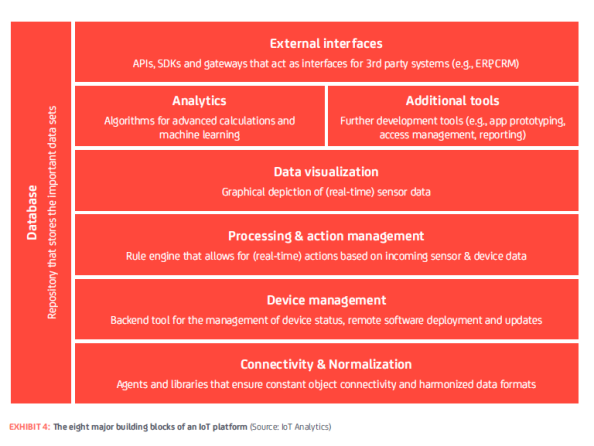

The architecture of an IIoT platform is very diverse from a vendor’s perspective but does, typically have as part of its solutions, several essential components. Basically, you expect:

Firstly, the ability to offer device management for endpoint provisioning, remote configuration, monitoring, and software update capability. Also, they have connectivity management to allow data from the edge (the asset) to the cloud through clear encryption capabilities. They offer to process the data in the processing and management modules on their IIoT platform. Then to enable the understanding of the data flows, they all offer in varying degrees visualization tools, dashboards to help manage and understand this as close to real time as needed. Then they offer advanced analytics and machine learning to varying degrees. Finally, they all are building and working on application enablement, in the form of API’s as part of their appeal, as the platform-as-a-service value proposition. These apps are specific solution needs and do offer the real client specific value add. In some ways, this is the point of possible “lock-in” as you increasingly rely on these.

To build an industrial-strength edge-to cloud platform you need to combine the technologies and digital solutions of today, breaking down the offering into a modular design of microservices that allows the solution to keep pace in a rapid technology innovation world. Overcoming multiple legacy issues is a real challenge for most.

As GE states in its literature on the value of a platform solution, you need to spend years:

“getting the underlying plumbing and commercial back-ends right and that is at present a work-in-progress for all. A platform to allow the client to plug into, connect all of itself up, scale up and down as market dynamics change” deciding which mix of platforms works for you becomes hard.

This is far harder as each client connection has its own unique set of challenges and solution needs. It is a real learning journey as you transform everything physical into digitally being connected.

Selling and constant change is not an easy sell for the Platform provider or for clients to understand and manage the risks associated. The value propositions for “uptake” need far more work to build even more of the platform momentum we are seeing.

I really like this IoT Analytics exhibit on the eight main components of a platform

The issue that needs to be addressed is getting more to buy into these platforms

A platform can’t stand alone.

A platform needs activity, it requires connections, it needs to be part of an Ecosystem, it needs a whole community of vested parties, bringing something to the platform partly to make it work and perform. Platforms rely on connecting and building relationships that are complimentary. They must offer real value for the investment and costs involved in being involved in one.

The current business case needs further articulating on its value, not where many of the platform providers are focusing, on showing off their latest “bells and whistles.” Platforms are in constant construction and potential clients are well aware of this and most are holding off making a deep commitment. Presently they are in a (perpetual) pilot, waiting and learning as they attempt to understand their own digital dynamics, let alone what platforms can provide in new competitive positioning. Platform value needs to mature for all involved.

Platforms need the “network effect” to really provide the added-value. Today there are numerous claims the “our platform is an open one – open to everyone” but this always comes at a price and significant commitment to engagement. A price many are still unwilling to pay as the returns remain still somewhat unclear. A recent Frost and Sullivan view recently suggested a few.

With significant investments in all these vendor platforms, there is a real pressing need to gain traction, to get uptake. Predix, the pioneering platform from GE is trying to regain traction as their product revenues seem to have stalled around $1.2 billion. I have read many of the “fast followers” like Siemens and Schneider Electrics, are somewhere in the $500m to $1.5 billion ballpark, in revenue.

Sometimes it is not so easy to find these figures as they often are getting buried in the division’s performance or not identified in explicit ways. Partly this is determined by where the platforms are housed. Siemens has a Digital Factory Division, GE has its GE digital group but is about to spin this out into a separate entity, ABB less clear and Schneider Electrics wraps in, it seems, under R&D.

There is a worrying trend that some of the growth in these platform providers comes from “imposing” on the business units the requirement to go through their specific platform offering. This might hide real external progress as most of these providers, especially GE and Siemens have massive revenue from these business units.

Of course, there should be synergies and greater potential to build digital solutions in-house but the relationship should be put on a transparent footing, where alternatives are evaluated. Resentment does build up if that internal supplier of services might not be responding as well in an open, transparent marketplace

Growth is not manifesting itself as well as expected

For instance, GE has resized its 2020 objective back to $12 billion in 2020 but this is all of its digital business, not just platforms; its present How GE resets its digital ambition will be determined by the success and investor attraction as it separately spins out from being under the current corporate GE umbrella. Siemens breaks down its Digitalization as around Euro 5.2 billion; most still go towards Siemens software that has been around for some time and digital services at Euro1.2 billion. Predicting market growth for Siemens is at 10% y/y over the next four years I find as disappointing.

I have to be honest here, I do struggle at the moment to nail down specific numbers for many of the essential performance numbers of “pure” platform services, but partly this might be deliberately ‘clouded’ as they continue to invest and are more than likely loss makers in their own right., at present They need broader digital cover, such as a healthy PLM business, as is the case with Siemens.

I think we must push for platform providers to offer basic comparisons, yet for that to happen there needs to be a standard reporting structure or some reality check. In 2019 we might get some of this as the present This will eventually help clarify the ‘real’ market of platform provision. It will actually encourage “wavering” clients to make decisions they are presently putting off. A clarity in revenue and relevant numbers do need to be addressed by platform providers to inject greater confidence for many potential clients. It is left to individual markers that are not easy for market comparison.

Sales are searching for value propositions to sell their solution

Of course, when you are building your markets you search for selling points and platform providers are no different. Mindsphere Application Centre is offering a growing number of application centers around the world, 900+ developers in software as it builds its “open” partner ecosystem. GE has recently restated its revenues (and will do again soon), but the Revenue of £4 billion was on annual growth of 12 %. Predix claims it has above 250 applications (APPs) and 22 000 developers working on Predix. That has been rapidly changing in the past year, more likely downward as they have been seeking to reduce costs, consolidate what they provide and work through their new arrangements with Microsoft. We will learn more in the early months of 2019 on a more current platform performance from GE.

Just looking at these two, Siemens and GE, they see their digital world very differently. Both are placing significant value on developing the “Digital Twin” with GE claiming 670 000 of these, but they will vary in size, what makes up a digital twin in the software packages and complexity for sure, compared to Siemens seemingly more measured approach.

Siemens is “fusing simulation with machine learning in constructing “Digital Twin solutions” by building the digital learning through different iterations of Virtual Product builds first, Virtual Production second and then twinning finally in real production. I like this approach; it provides a sound digital development process.

ABB has presently about 210 industrial internet solutions. There is a consensus that the “digital twin” holds real promise for justifying platform involvement. Building these digital twins can take time. I am very surprised at the GE number of 670 000 and assume this is a twin for each asset sold. Siemens approach to dealing with the “digital twin” seems to be more considered for me.

As I can conclude, other competitors, are behind on building and offering clients a real in-house capability when it comes to digital twins, as it is not given the same emphasis in any documents I have read in ABB or Schneider or a number of others. Again comparing what is offered in digital twins by each platform provider would help the market make better (and earlier) decisions if having a digital twin makes sound investment sense to them.

Platforms are increasingly different, designed to solve their client needs

One other point of potential confusion (well for me) is each of these Industrial organizations is operating in different sectors. This can go from pumps, water treatment, power plants, control boards, aircraft, trains, grid automation to discrete automation process automation. The breadth of application and platform solutions requires each to design their platform to fit their market clients’ needs.

ABB seems to be very centered around managing control rooms and making this the automation digital core system as a more (present) dominating VP. Siemens and GE are building solutions for all their business needs. Schneider Electric is focusing on energy management and automation in homes, buildings and data centers.

One of the universal driving forces of all the digital work being undertaken in the IIoT world is the move to Industry 4.0. This is where the McKinsey value predictions come in. The attention this Industry 4.0 will be a huge catalyst for change and digital growth and promises to be more central to what platform providers can offer. I think we will see a higher emphasis on Industry 4.0 and platform providers in 2019.

I have been seeing a switch from Industrial 4.0 into Enterprise 4.0 and now the World Economic Forum at their January 2019, Davos meeting are pushing “globalization 4.0. It means for me “watch this (competitive) space” in 2019 evolve around whichever 4.0

Dark clouds need to dissipate

I do see some dark clouds on the near-term horizon unless all these industrial organizations don’t understand a business needs is to focus far more on a thriving ecosystem that is really open, mutual respecting in value and contribution. Today IIoT platform solutions seem very internally focus on the one specific organization that is offering the platform and tailoring solutions to their business needs.

I have written about some of these dark clouds gatherings during the course of 2018, in a number of posts. Scroll through my home page and read about different aspects on this darker side. I predict we will see even darker ones in 2019 as the platform market will come to terms with consolidation and the need for competitive transparency, in the greater market interest. We need to seperate the specialist from the generalist in platform offerings, we need to segment the market as I suggested here in this post “the confusing world of IIoT platforms needs to change in 2019″

Overcoming client resistance is critical to be resolved in 2019, bridging gaps

To gain traction, all the IIoT platform providers have pressing needs to overcome massive client resistance at this present time. Platform uptake is gradual, it needs a higher depth in resolution, in the value of platforms.

A report, sponsored by GE some months ago, was researching on the emerging gaps between executive outlook for digital transformation and initiatives organizations have in place to achieve a higher uptake and engagement in platforms It was highly revealing.

It found Eighty percent (80%) believe IIoT will or could transform their companies or industry. Only 8 percent yet say digital transformation is ingrained in their business and 10 percent have no digital transformation plan even in place. The reasons were varied but significant to find solutions too rapidly by the platform providers.

We equally know 46% of organizations are either investing in by learning about platforms as well as considering their needs for a new platform business model.

So today it is all to play for as we enter 2019.

We are still only at the beginning of IIoT, of platforms, of digitalization being realized by the majority of industrial companies. A lot of unresolved issues and uncertainties are holding the majority back in making really committing investments. There are far too many ongoing “pilots” occurring, waiting to see which ways the platform providers “break” in ambition, in costs, in alliances, in their future positioning.

Finally, the key to really making the level of platform progress is the convergence of IT and OT.

It is the platform that will become the meeting point for IT/OT convergence. The current separate worlds are being forced to find solutions for any Industry 4.0 set of solutions Software, hardware and experts like engineers need to come together. It is technology, process, security and organizational “fusion” is a key success factor and becomes the evolution/prediction for me in 2019 as the gathering point around platform solutions. It is happening at fast rates of change where the need to fuse operational technology (OT) with IT needs the platform solution provider to solve this as the catalyst for new ways of thinking.

In summary beside money, it is trustworthiness of the vendor and the fear of early lock-in, the ability to truly connect to the platform and gain returns on the investments made. The applications claimed are real solutions to their problems and the real task of re-orientating the organization into a digital reliant one. These are actually far more of issues to bridge and overcome but these mentioned above are wicked constraints, that need to be overcome. Picking up on these gaps is essential to know if you are considering a platform solution.

IIoT platforms are evolving. To learn more or delve deeper why not ask through IIoT-World more about platforms. Where are you in your IIoT journey, need any help?

**The bulk of this article was written and released earlier this year (2018) through IIoT-World and been partially updated to reflect some changes in market positioning and insights gained since then. Industrial platforms are a very dynamic story, told in individual ways, often hard to piece together for many to understand and evolves quickly.