Sadly, yesterday, 4th November 2019, the United States began the process of withdrawing from the Paris Agreement, notifying the UN of its intention to leave.

Sadly, yesterday, 4th November 2019, the United States began the process of withdrawing from the Paris Agreement, notifying the UN of its intention to leave.

The notification starts a one-year process of exiting the global climate change accord, culminating the day after the 2020 US election.

The Paris agreement brought together 188 nations to combat climate change. The Paris accord agreed in 2015, committed the US and 187 other countries to keep rising global temperatures below 2C above pre-industrial levels and attempting to limit them even more, to a 1.5C rise. Climate change, or global warming, refers to the damaging effect on the atmosphere of gases, or emissions, released from industry and agriculture.

In a publication “The Paris Climate Agreement versus the Trump Effect: Countervailing Forces for Decarbonisation,” IIEA Senior Fellow Joseph Curtin argues that the “Trump Effect” has created a powerful countervailing force acting against the momentum which the Paris Agreement on climate change hoped to generate. The real concern is that this decision will give instability and uncertainty until broader and deeper structural factors within the US political economy can be addressed as their (the USA) issues around energy resourcing, infrastructure, and urbanization are as much in crisis as anyone else. Can this national determination by the present administration go against the tide of so many?

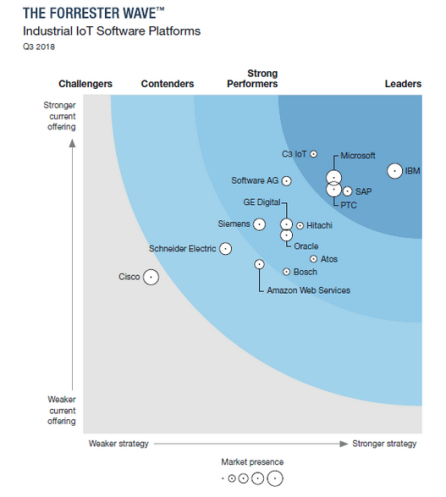

I feel 2019 will be a make or break year for the platform providers for IIoT solutions. We are getting a real sense of clarity on who is leading the pack, who is struggling to keep up and some becoming real laggards, that need to change their game dramatically to stay in the platform hunt.

I feel 2019 will be a make or break year for the platform providers for IIoT solutions. We are getting a real sense of clarity on who is leading the pack, who is struggling to keep up and some becoming real laggards, that need to change their game dramatically to stay in the platform hunt. Ecosystems in our business thinking have suddenly become of age, they can enable cross-cutting innovation to be delivered in highly collaborative and dynamic ways. Understanding the value of working within an ecosystem is becoming critical to understand.

Ecosystems in our business thinking have suddenly become of age, they can enable cross-cutting innovation to be delivered in highly collaborative and dynamic ways. Understanding the value of working within an ecosystem is becoming critical to understand.

Ecosystems have become a really hot topic. As we gain the understanding of what a dual strategy approach to what our business could look like, you need to recognize what you still need control of, those you call your core assets. Yet at the same time, to explore and expand out more today we need to build better external collaborative approaches.

Ecosystems have become a really hot topic. As we gain the understanding of what a dual strategy approach to what our business could look like, you need to recognize what you still need control of, those you call your core assets. Yet at the same time, to explore and expand out more today we need to build better external collaborative approaches. I had mentioned in a related post on my other

I had mentioned in a related post on my other

In my opening post (

In my opening post (