I have been reflecting recently on where we are in all the efforts, focus, and resources, that have been going into the building of our IIoT platforms. This has mainly been around the questioning of where they should fit within the needs of an ecosystem, the end outcome of our new industrial design, in my opinion, that enables digital transformation.

I have been reflecting recently on where we are in all the efforts, focus, and resources, that have been going into the building of our IIoT platforms. This has mainly been around the questioning of where they should fit within the needs of an ecosystem, the end outcome of our new industrial design, in my opinion, that enables digital transformation.

Let me offer up an initial case of why there is a need for a change in where we are on IIoT platforms and their current emphasis and focus on how we need to change the value equation out in the future in our solution designs and positioning of platforms, as a need to achieve. This is based on considering a greater ecosystem perspective, one that provides a sizable move towards a digital transformation we need to make.

Here I attempt to lay out the current position and suggest there is a case for change. The IIoT platform provider needs to change their value proposition urgently, in my opinion, or move along a faster evolutionary curve certainly, to get clients seeing their own value-add endgame, not just the IIoT providers race for dominating the platform space.

So let’s look at where IIoT platforms currently are, and in my related post where we might consider some changes in how we are evolving the platform story.

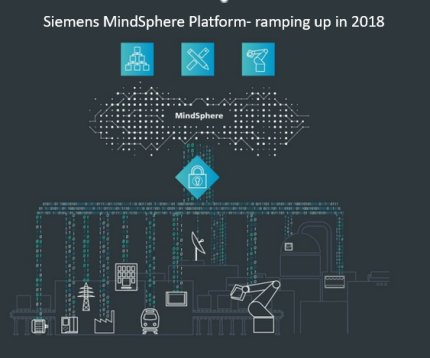

As I have been focusing on the Industrial platform providers like Bosch, Siemens, Schneider Electric and GE, you constantly see part of their partnership validation has been with Microsoft Azure, or Amazon and AWS or even both in some form or another. Comforting, reassuring perhaps, or is it?

As I have been focusing on the Industrial platform providers like Bosch, Siemens, Schneider Electric and GE, you constantly see part of their partnership validation has been with Microsoft Azure, or Amazon and AWS or even both in some form or another. Comforting, reassuring perhaps, or is it? IIoT platforms-as-a-service are gaining ground. In

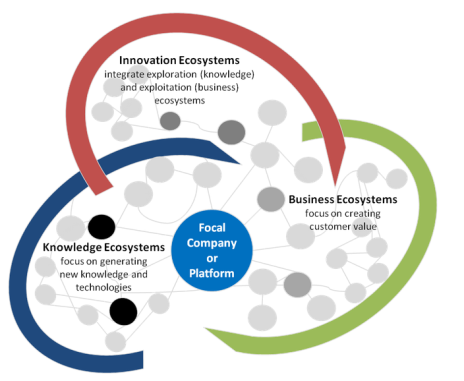

IIoT platforms-as-a-service are gaining ground. In  I am getting fascinated by platforms and ecosystems. Does it show? This is why I am increasingly spending more time in this area as it is highly innovating in its potential.

I am getting fascinated by platforms and ecosystems. Does it show? This is why I am increasingly spending more time in this area as it is highly innovating in its potential. I continue to look at the world of IIoT solution platforms that are being offered to their customers which are digitally enabled, requiring connected devices to improve efficiency, productivity and increase profitability, all being provided through digital platform offerings

I continue to look at the world of IIoT solution platforms that are being offered to their customers which are digitally enabled, requiring connected devices to improve efficiency, productivity and increase profitability, all being provided through digital platform offerings Whenever I seem to read about Platforms and Ecosystems, it mostly seems to relate to technology-led organizations and how they continue to connect us all up in our private lives.

Whenever I seem to read about Platforms and Ecosystems, it mostly seems to relate to technology-led organizations and how they continue to connect us all up in our private lives. The move towards open-cloud based IoT operating systems has been significant in the past few years or so. Most major industrial companies have set about building and offering to their clients their platforms, for more open design and engineering, automation and operational work, as well as increased emphasis on maintenance and utilization.

The move towards open-cloud based IoT operating systems has been significant in the past few years or so. Most major industrial companies have set about building and offering to their clients their platforms, for more open design and engineering, automation and operational work, as well as increased emphasis on maintenance and utilization. I see the growing importance of ecosystems and platforms for those that want a thriving future, these are the ones that simply “get this” need to connect into a wider ecosystem to build better value and solutions that customers want. The business imperative of today and near-term future is designing around ecosystems that seek out collaborative platform solutions.

I see the growing importance of ecosystems and platforms for those that want a thriving future, these are the ones that simply “get this” need to connect into a wider ecosystem to build better value and solutions that customers want. The business imperative of today and near-term future is designing around ecosystems that seek out collaborative platform solutions.

There seem to be multiple forces at work, ones that are reshaping how organizations are adjusting to a rapidly changing world, to operate within.

There seem to be multiple forces at work, ones that are reshaping how organizations are adjusting to a rapidly changing world, to operate within.