It does seem every time you read about GE it seems to be under a relentless barrage of negative news coverage.Then the stock is continuing to get a hammering perpetually.

Mistakes will be also made going forward, as the current management tries to “right the ship” after so much mismanagement. Digital course correction might be one of these mistakes.

For me watching the current GE story unveil itself it, just fills me with a real sense of sadness. Clearly, it now seems GE lost its ability to listen, reflect and adapt, its management was cutting many governance corners, pushing for performance that was not as much in the ‘tank’ as they thought and placing bets on the future, that was very bearish and as it is now revealed, possibly reckless.

GE as a group business was being pushed on, regardless, it sort of ploughed on as a supertanker does, unable to make the course corrections it was required to do, as its steering was jammed in ‘full speed and forward drive’, regardless, ignoring dangers, possibly sealed in its own bubble, one of believing it was invincible.

Yet one of the boldest moves made in the reign of Jeff Immelt that might have been a substantial transformation was the shift to digital that he underpinned, although there have been comments I have seen by outsiders of “the endless checkbook.” All I can say is that you have to invest in opportunities like this, they are so transforming. The ability to spot the industrial internet was one of his positive signature moves, taken I believe nearly a decade ago – a lifetime in the digital world. So lets update where we are.

Warning messages, yet full speed ahead, Immelt was a believer.

GE really did get caught-up in the hype of its own messages and took on the ‘jargon’ of the startup, learning to be agile, lean and pivot in executing, especially on their digital transformation. A New York article written in August 2016 foretold the risks in GE: The 124 year plus industrial software start-up. on the digital transformation.

In this New York article and I quote: “G.E.’s success or failure over the next decade, Mr. Immelt says, depends on this transformation. He calls it “probably the most important thing I’ve worked on in my career.”

Apparently, there is no Plan B. “It’s this or bust,” he said.”

As we now know reality has finally struck and GE is in a very difficult crisis of market confidence, across most of its business, as it reveals these mistakes on a constant, sometimes drip by drip basis.GE under its new CEO and Chairman John Flannery, are returning to their roots, where performance is embedded in all they deliver. So there is an emerging plan B even for the Digital Transformation.

Change takes time to absorb, past, present, and future

New methods and concepts take time to absorb and learn, in ways that sometimes are far beyond the understanding of the organizations’ employees in applying these to add value. Becoming an industrial digital company is a deep, sustaining undertaking. Those underneath were not as well-equipped in their ability to realize; as engineers, researchers, salespeople, on what to learn and apply as the new digital ways. Constant changes that were being demanded and asked out of them were coming thick and fast. Perhaps it deflected away from the core They were ill-equipped to transition into the new digital era at a “start-up” speed expected by Immelt. It takes time, where you build out the ‘network effect’ and find new ways to collaborate, and not impose your solutions, your listen, reflect and adapt to client needs and many times let them led with solutions..

Digital equally has equally needed to be reined in and refocused in today’s reality.

Mistakes have been made, a warning ignored on the digital transformation. Let’s look at some of these.

In Immelt’s classic optimistic view, supported by those equally buying the GE transforming story, of being the “digital industrial company,” this GE digital business was going to become a $15 billion business by 2020. This was revised down to $12 billion when double accounting and internal mechanics were accounting definitions were being adjusted, to say the value of software-enabled product upgrades needs to be accounted for differently, than new to the market “pure” software business.

Yearly budgets of billions were added into the digital solutions all the time, a further $700 million additional was required in 2017, continuing the spending spree. I gather $4 billion has been quoted as invested in this digital business so far. As spending in this digital initiative grew, it equally helped weigh down on group profits. Predix as a platform service was central to this digital transformation and it has not yet achieved a $1 billion revenue in a year.

In GE’s view, a digital dawn was a full feature in their 2016 Annual Report

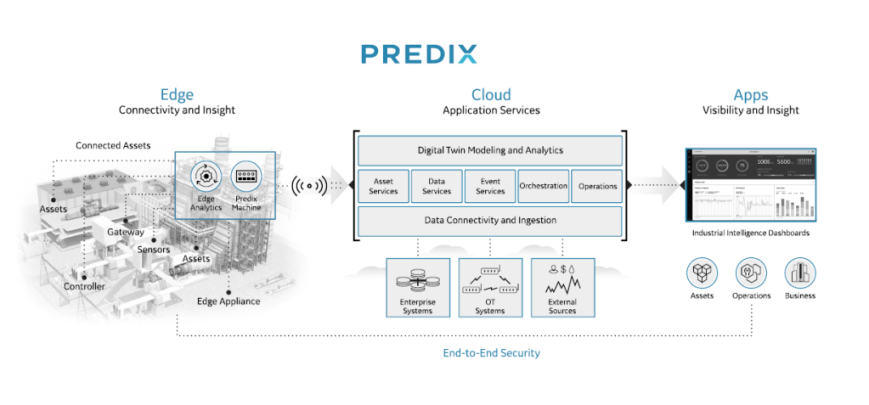

“At its core, a digital industrial company uses data and analytics to create a “digital twin” of each of its processes and physical assets. This digital foundation enables the company to drive down costs while delivering consistent quality. It also enables the company to run a “digital thread” through the design, build and service functions, using analytic intelligence to create a virtuous loop that delivers continuous improvements to equipment for customers”

As we reflect back, Immelt pushed digital everywhere within the group, hard. He wanted always to go sooner than any other companies to capture this industrial internet (IIoT) market. He took a highly offensive market position of taking no prisoners, all GE needed to do was “take the IIoT digital hill” at all costs. Go do it!

Aggressiveness has a price

When you take such an aggressive stance you are often in search of new meaning. You have to back this vision up with a strong investment in growth orientation by investing in new capabilities and pursuing new market models. Others were simply expected to only follow, fall in line the typical GE way, simply determine to come along or stay on the sidelines. Many waited…..curious.

As a first-mover on this specific opportunity, of the size of GE, a number of mistakes were made. Immelt was learning about a very different world of digital-light versus physical ‘heavy’ assets, massive to understand and translate, possibly deflecting him from the present core of managing such a company the size of GE, stepped in building plant and machinery for major industrial sectors.

Asset-light worlds are managed differently

GE was suddenly competing in an asset-light world, where speed, scope, scale, size all took on a completely different meaning in the digital environment. Competitors were more agile, dynamic and evolving at totally different evolution than machinery and plant. Actually, software is a very different business. A world where to compete, it required GE to perform major surgery on itself, a “transforming effect”, a change of huge magnitude and no time to allow it to simply filter and trickle down, it needed imposing from the top.

The new culture of lean management thinking suddenly had a real purpose for managing massive amounts of data, fast iterations and constant refreshing of applications onto thousands of employees not attuned to being ‘digital natives’.

GE had entered into a very different part of the ecosystem terrain. I think it actually overwhelmed many as massive change, firstly confront you and then you need time to absorb what this means for you, many did not, or cared not too, it had not been part of their job.

As my opinion I think the past culture dominated, it rose back up, one of staying with what you know, look after yourself first, adjust when it fits your accountable business objectives and your divisions need to achieve the quarterly numbers.

Digital and the Predix platform does have the potential for a lasting positive contribution, if it is not relegated as a supporting group, in these times of real GE crisis. Today GE is in crisis time, one of needing to focus way beyond the normal, to survive and does this bold digital decision suffer. Certainly digital is getting a sharper focus to simply support GE businesses.

A world full of highly adept and seasoned technology and digital competitors owning the block

How does a company like GE compete? In Immelt’s view, you take them on. GE had size, scale, scope, and ambition to transform the industrial industry. He would not hunt in a pack, he was the lone wolf, all teeth, and self-belief. Yet when you come up against the likes of Amazon and Microsoft, who were spending tens of billions of dollars on data centers, cloud services and the constant ramping up for the total Internet of things (IoT) it is a totally different “ballpark” to what GE had been used too.

It failed to recognize every platform for digital solutions needs a rich ecosystem to feed it. Amazon’s AWS and Microsofts “Azure” were competitors GE simply could not compete with. The significant onboarding cost of 20,000+ software engineers, grounded in software but mostly lacking in industrial experience was another costly call. Ecosystems have many predators, some evolve quicker than others, no matter how you try.

Internally within GE, the structure of each division became another difficulty to overcome.

Taking digital into a separate division added to internal conflicts. The ability to overcome so much legacy within installed plant and machinery equally gave its challenges to software design. Over the years different coding languages, limited capacity, older devices to accept updates, to make the actual connections into a network, that can truly utilize the network was costly and time-consuming. It consumed much to work out and overcome.

Predix was consuming much of the attention in the group divisions as the need to implement came from the very top. Selling to customers became more selling digital solutions as a “must” on complicated plant and machinery deals. GE Capital was not the same type of friendly banker to help “sweeten” these deals as in the past. Digital was partly laying on complexity and additional cost. GE’s market position was shifting in its competitiveness, the future vision was up against today’s hard-nosed reality on spending by its customers. It pressed on regardless. Ignore the environmental conditions within the ecosystem and you can be at peril.

Performance failed to deliver on the hype sold

Even when solutions involving digital as a critical part, the disappointments came as installations, performance and digital solutions sold was not as customers had been promised. Even the applications they were provided lacked the specific features that worked for their business. Technical, structural and operational problems lay underneath the veneer of digital being the magic transformation bullet that Immelt expected.

GE Statement- Reality hits home but the IIoT potential is huge.

We have learned in post-Immelt how he did not like bad news. His self-belief ignored a raft of problems within digital and Predix. The market and many of GE’s most critical clients were not getting what the “hype” was promising. Customization to client needs was a far bigger problem than recognized. Laying on more money to fix it was only part of the solution, you actually needed to know how to do it!.

Ramping up a software business such as the ambition of Predix was very hard. Although the tantalizing prospect of the industrial internet market was predicted to be worth $225 billion by 2020, GE was increasingly being bogged down by the push in over-promise and under-delivery

If you are a hunter, leading the attack, carving out a new territory, the understanding of the ecosystem and what that means for you to be adaptive to it, needs deep understanding., otherwise, you enter a new curve of reality. Reassessments were needed.

The Course Correction of the new GE management team for Digital

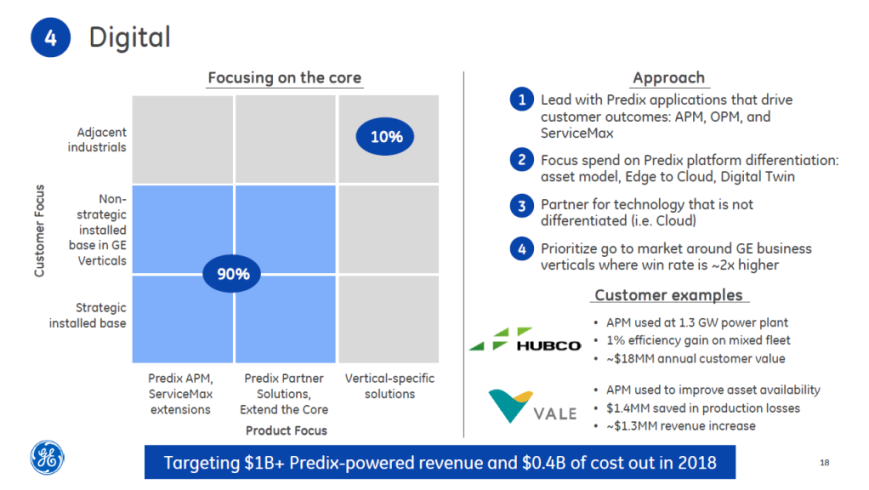

GE new Positioning statement, November 2017 Investors Call

A course correction – dealing with missteps, calling “time outs” and tightening the scope is today’s need

There are numerous course corrections taking place within the Digital division and Predix. To quote

Recent GE Statement of GE Digital’s new positioning inside GE

So there is no change in GE’s belief in the digital future- the “adjustments” they are making will take GE from being the “first mover” into more of a “fast follower” as it continues to ‘double down’ and start delivering on the promises it has made or the real promise that still does lie in Predix as a solution. The ultimate shift within GE Digital will be that its resources will go into their fastest-selling markets.

Todays GE Digital Predix Model

GE in taking leadership in defining, developing and building the Industrial Internet (IIoT) has shaken the cobwebs out of many of its competitors. Seeing that a potential IIoT market at $225 billion by 2020 just cannot be ignored, it needs a response, a measured response.

Why measured in response?

Even though GE and Predix have been pioneering much within the market, others have been these “fast learners” to catch up and avoid a number of the costly mistakes made by GE. We are seeing thoughtful responses to the platform-as-a-service, from the likes of Siemens, ABB, Schneider Electrics, Bosch (all discussed here in this site) and more restrained digital models from Honeywell, Emerson, Ericsson and many others. Each is learning as they go. They all have, including GE, a very long way to go and I will be exploring that in future posts and featured articles on IIoT.

In the meantime, GE absorbs its ‘course corrections’. Predix I gather is more stable and focused. A partnership with Microsoft Azure, there has been a constant shift in GE digital leadership as well. The business is shifting from a software dominated, Silicon Valley diet into a Corporate one. What that will mean in a change from being a ” pioneering leader” into being part of a “hunting pack” alongside your competitors and their digital offering is yet to play out. As GE’s competitors take aim at the prize of digital it makes for a very different “maturing phase” of the IIoT market. We are seeing a number of nimble start-ups pushing to nibble away at a vast array of gaps in solutions provided.

Recent GE Platform Statement

Predix, the GE digital division might seem vulnerable, as it might equally get caught up in the selling off the pressure that GE group are under to “right the GE ship” but it can’t afford any more digital mishaps. Getting the Predix platform-as-a-service right and at the scale and scope of its client’s needs, not their own is a real challenge.

Speed is still important, responsiveness in a dynamic technology evolving marketplace will still remain crucial but if GE digital does learn how to “double down” and focus on delivering performance that its clients want then Predix will pay off really handsomely.

Yet it is going to be a difficult transition period, with so much “snapping at its heels” in internal decisions of GE’s assets, the competitive threats that are absorbing digital in their own ways and learning what digital platforms can deliver to GE’s growth and immediate cash needs.

What all within IIoT and their digital platforms need to learn is, the platform can provide but it does need to understand and listen well to the Ecosystem that ‘feeds’ this platform. Presently I don’t think ANY have got beyond stage one in this Ecosystem thinking, even if they talk the word. Still, that view can be left for another day.

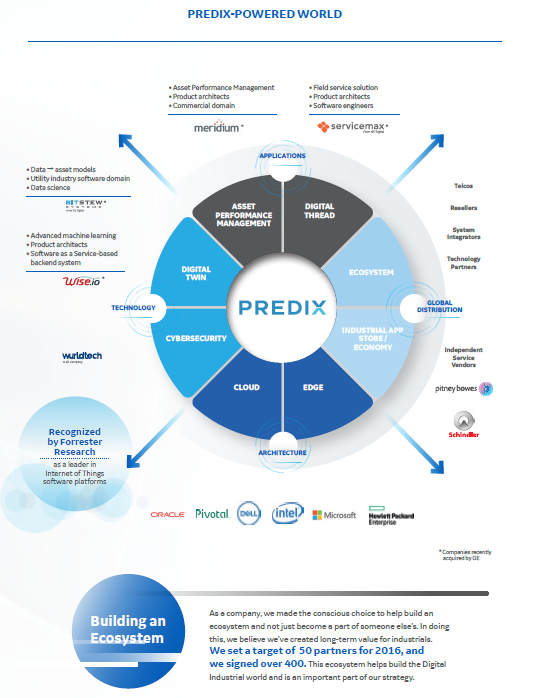

Even in the Predix -powered world there Ecosystem is not rich enough

Platforms may be central to performance but they are not the center, as this GE visual projects. The Ecosystem design is far more relevant and necessary. This tends to be far more supply sided not demand-needed.

Taken from the GE Annual Report 2016

Predix was a pioneer, will it be in the future?

It is most striking but GE Digital was the opening part of the 2016 Annual Report. It was glowing with optimism. In the 2017 Annual Report, it hardly gets a mention! It is not even reviewed as a division. You can argue “oh how the mighty have fallen” but beware “digital can eat far more before breakfast“, including today’s’ prescribed new strategy.

It remains for me and many, many others, to thank those that took a vision of the Industrial Internet, who made it a real mission, one that had a total believer in the ex-GE CEO and gave us Predix, a platform that has kick-started the Industrial Internet.

The pioneering was expensive, littered with many missteps and learning but it can still pay off really well for Predix and the GE digital path if it chooses this well. GE played a major part in establishing the IIoT is a reality and still provides a real market opportunity, one that is poised to be exploited as much of the investment has hopefully been made.

Where we are today, a full-blown GE crisis is down to GE management to fix. Even though GE and Digital have taken a real bruising it still provides a powerful base for re-engaging and hopefully not relegated to the back-office, just supporting. GE Digital and Predix specifically still needs to lead not follow.

Now we are at the point where the market will decide on what value it gets out of this rapidly connected IIoT world. An awful lot if its predicted worth is based on the market growing to $225 billion by 2020, and the prospect of connecting your physical business with a real digital growth path is highly attractive. I think GE through its Predix platform will play a continued major role, unless it is decided to sell it off, as part of the shoring up of the rest of GE.

I finish on this point. The Dynamics of any ecosystem design are ones that always have winners and losers, that is what evolution is all about. Others might be stronger to prosper and grow as GE adjusts to their new world of reality, forced only on themselves, as first-mover advantage fades into the distance and the pack had the time to catch-up.